Editable IRS Form 5500-EZ for 2023-2024

Show details

Hide details

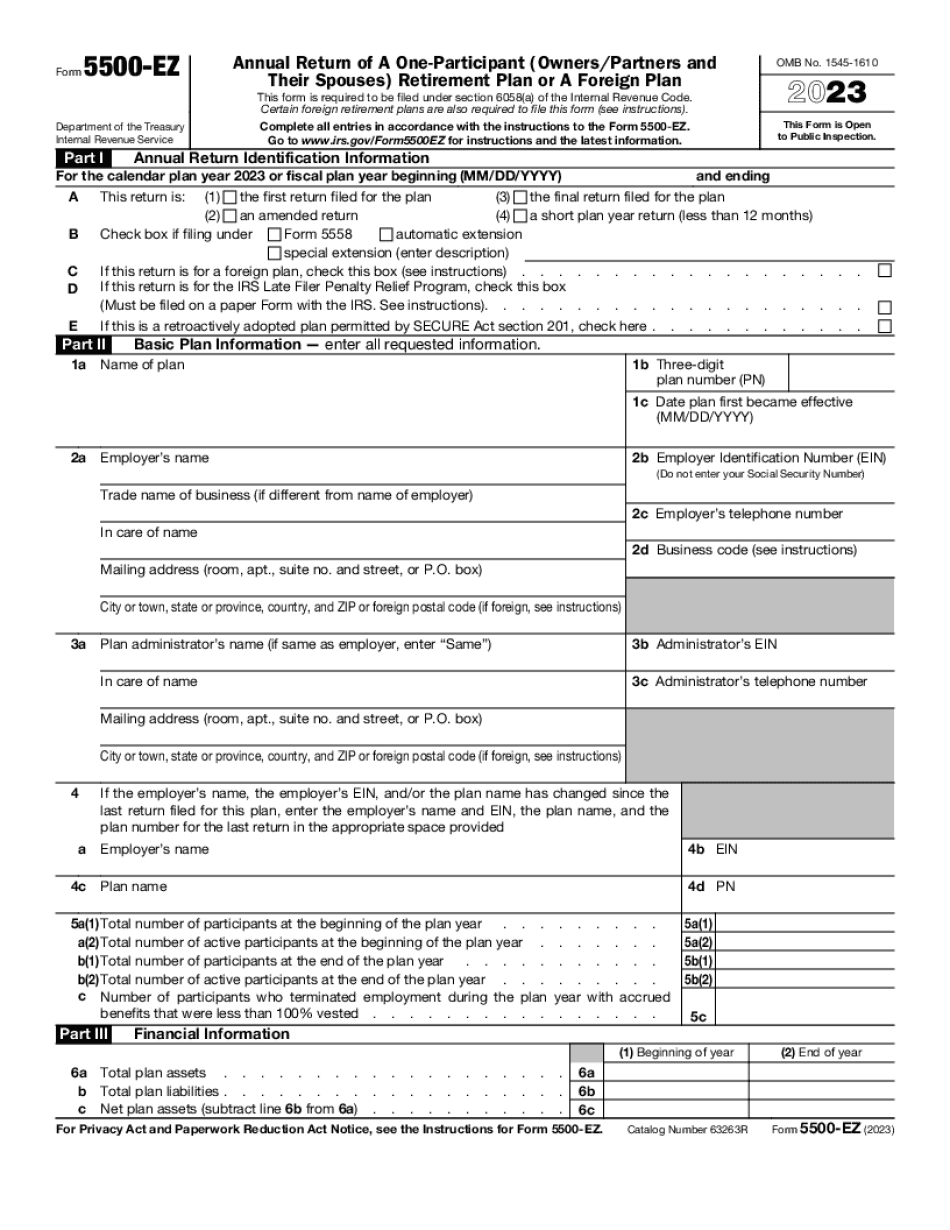

Ibutions for all years from Schedule SB Form 5500 line 40. Form 5500-EZ Annual Return of A One-Participant Owners/Partners and Their Spouses Retirement Plan or A Foreign Plan This form is required to be filed under section 6058 a of the Internal Revenue Code. Is this a defined benefit plan that is subject to minimum funding requirements If Yes complete Schedule SB Form 5500 and line 10a below. 11e Caution A penalty for the late or incomplete filing of this return will be assessed unless ...

4.5 satisfied · 46 votes

form-5500-ez.com is not affiliated with IRS

Filling out Form 5500-EZ online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form 5500-EZ

Every citizen must report on their finances on time during tax season, providing information the Internal Revenue Service requires as accurately as possible. If you need to Form 5500-EZ, our reliable and straightforward service is here at your disposal.

Follow the instructions below to Form 5500-EZ promptly and precisely:

- 01Import our up-to-date form to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official instructions (if available) for your form fill-out and attentively provide all information requested in their appropriate fields.

- 03Complete your document utilizing the Text option and our editors navigation to be confident youve filled in all the blanks.

- 04Mark the boxes in dropdowns with the Check, Cross, or Circle tools from the tool pane above.

- 05Make use of the Highlight option to accentuate specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or remove unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to ensure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to electronically send your report from our editor or choose Mail by USPS to request postal document delivery.

Opt for the best way to Form 5500-EZ and declare your taxes online. Try it now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is Form 5500 Ez?

Online technologies enable you to to organize your document administration and raise the efficiency of the workflow. Observe the quick guide in order to fill out Irs Form 5500 Ez, stay clear of errors and furnish it in a timely manner:

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 5500-EZ?

The purpose of Form 5500-EZ is to provide federal employees an easy method of reporting the receipt of goods and services, such as travel, hotel, food and entertainment, that they receive on official government business. The taxpayer should complete a Form 5500-EZ and file it with their Form 1040 or Form 1040A. The Form 5500-EZ is generally used by an officer or employee of the government who makes a living primarily from salary and who receives substantial personal benefit from the travel business.

How do I report an event on my Form 5500-EZ?

When the reportable event exceeds the 100,000 thresholds, the Form 5500-EZ must be sent to the Internal Revenue Service. The IRS must determine the amount of a payment made by an employee while participating in a government travel-related event that exceeds the 100,000 thresholds. The tax is calculated in the year the Form 5500-EZ is filed. For more information on how to calculate and report travel expenses on Form 5500-EZ, go to.

I work in a government contractor. Am I required to file a Form 5500 for the services I receive?

Yes. The contract the employee works for must be filed with the contract or grant application. If the contractor is not a government contractor, the Form 5500-EZ must be filed with the grant application or if the services are performed through grant, solicitation, submittal or similar procedure, with the grantee's grant application.

How much does Form 5500-EZ cover? How much do I report on my return?

In general, the cost of meals, lodging, gratuities, parking fees, gift goods, transportation and the like is treated as taxable income.

If the amount of the reimbursement exceeds the 100,000 thresholds, the employee's gross income is subject to tax at graduated rates. The base of the tax is 3,050. Subtract 2,250 of the difference between the maximum and minimum amounts from gross income. If the taxable portion of income exceeds 3,050, gross income may decrease by 250 and the additional amount of tax imposed on the employee may be increased by 100.

Who should complete Form 5500-EZ?

If you are a U.S. citizen who acquired your U.S. citizenship through a parent/guardian.

If you were born in the U.S. or its possessions, Puerto Rico, or the U.S. Virgin Islands, and you've never been present in a country or territory of U.S. Citizenship or Immigration Services jurisdiction at any time during the past five years and for which you have never been listed by the Department of Homeland Security (DHS) in any Suspicious Activity Report. If you are the beneficiary of a trust governed by a foreign law or of which less than fifty percent of the beneficiary's interests are owned by foreign nationals, and you have a spouse, child, parent, or child under age 16 and not deceased or a person with an outstanding loan, lease, or contract, and you do not have legal residence or social security number (number that identifies the legal right to live and work in the U.S. or its possessions) with the government of the country or territory you're residing in. If you are a member of a military unit (including the U.S. Coast Guard) based in a U.S. territory, and you are not a citizen of that territory. If you were granted U.S. Permanent Resident status, U.S. Citizenship and Status for Lawful Permanent Residents (DATA), or any other type of U.S. citizenship in the last five years. If you were either naturalized and have been in a foreign country or possess proof that you have been granted a visa or other documentation indicating your intention to settle permanently in that foreign country or territory, or you have been physically present in that country or territory more than fifty days in a one-year period during the last five years. If you were married to, had a child who was an American citizen or green card holder at the time they acquired U.S. citizenship, and you are unmarried. Proof of U.S. presence may include, but is not limited to, a Form I-551, Nonimmigrant Visa (B1), Travel Document, or other documentation establishing permanent residence that shows a person was in the United States for more than seven days within the most recent twelve-month period. This doesn't include permanent residents who entered the U.S. as children under age 14 who are granted deferred action or the Deferred Action for Childhood Arrivals (DACA) program.

When do I need to complete Form 5500-EZ?

You must complete Form 5500-EZ by May 31 of the year following the year in which you leave the United States. You cannot use your Form 5500-EZ to request employment in the United States in any month after May 31.

What is the maximum amount of Form SSA#82 that you may use to claim a refund check or claim tax credits?

You may use up to 3,000 in Form SSA#82. Your total Form SSA#82 filing limit is determined by the amount of Form SSA#82 that you filed for each employment year, in addition to the filing limit.

How do I report the employment income I receive, or the employment expense I incur?

Use Code 11 in the Instructions for Form 1125-F to report the employment income you receive or the employment expense you incur. Report the income in the employment column on Part I, line 7, and the expense in the expenses' column on Part II, line 2. Use Code 26 in both columns to report the employment tax credit you received. Use Code 13 in both columns to report the employment expense tax credit you received. You may also use Code 13 in the Form 1125-F for employment income and Code 26 for both income tax and tax liability reporting.

Additional Instructions

I'm an employee. How can I report the income and employment tax information required by section 5405 of the Internal Revenue Code?

To file Form 1125-F, you generally must complete Part I of the Form1125-F, attach a completed IRS Form 4506-C, Form 2106-X, or Form 2105-X (if you report the employment tax credit), and file it with the completed Form 1125-F. If you are an employee, you must complete Part II of Form 1125-F, attach a completed IRS Form 4506-A with your Form 1125-F and filed with the completed Form 1125-F. If you report the employment tax credit, you must complete Part III of the form. You must attach a copy of your Form 941-X, or other similar federal return, to Form 1125-F as required. Report the employment tax information reported on each box only once, for all employment tax years. The employment tax information reported on each box is required as provided in the instructions to Form 9007 for the appropriate year.

Can I create my own Form 5500-EZ?

Yes.

Form 5500-EZ is free for businesses with less than 2 million in assets or 20 million in revenue.

Form 5500-EZ requires:

Business to complete the Annual Statement of Financial Condition.

To complete Form 5500-EZ, businesses must include each business entity or person that performs the services to be included on the annual statement of financial condition. If a business does not include an individual, partnership, CULT, or non-resident entity on the annual statement of financial condition, then the entity must be added in the statements of income and expenses.

Additional Requirements

To be eligible for Form 5500-EZ, businesses must meet the following requirements:

Entities (excluding for tax years 2007 and 2008):

Must either be wholly owned or controlled by the applicant or its affiliates.

Only eligible companies must use Form 5500-EZ. For example, an eligible cooperative that is controlled by the applicant is not eligible to use Form 5500-EZ.

Businesses not owned or controlled by the applicant or affiliates and not engaged in a common business or activity must either:

Be subject to an income tax return that has its return due before the filing deadline and the income of at least 50% of the taxable business income must have been reported before the filing deadline. Taxpayers filing without the filing due date must file their Form 4668 (Individual Income Tax Return) first and then use Form 5500-EZ.

Only eligible companies must use Form 5500-EZ. For example, an eligible cooperative that is controlled by the applicant is not eligible to use Form 5500-EZ. Be subject to an income tax return that has its return due before the filing deadline and the income of at least 50% of the taxable business income must have been reported before the filing deadline. Taxpayers filing without the filing due date must file their Form 4668 (Individual Income Tax Return) first and then use Form 5500-EZ. No more than 5% of the business' gross revenue in their fiscal year.

Entities that will be engaging in the activity described above (tax year 2006 or thereafter) must either: Be a qualifying individual (generally a single person who meets income requirements but meets other requirements).

What should I do with Form 5500-EZ when it’s complete?

Form 5500-EZ is a free paper form that you must complete before you can receive your Pass tag for your next trip.

How do I get my Form 5500-EZ?

First off, be sure to have your state's registration number on hand, so you can order the form for your particular state when you return from your trip. This form is a legal requirement, so you'll need to give it as a present to a registrant.

Here's how one woman from Texas put it:

“I had a huge bag of these forms in my car because I wanted to have all of them when I got back. So I drove back to my car with the Form 5500-EZ under my seat, and I was so grateful to me that I had so many!”

How will I know I have one?

If your registration is lost or stolen, you can call the National Voter Registration Hotline at 1-800-232-VOTE (8683) to report it.

You can also contact your registrant and tell her what happened.

What's more, the Department of Motor Vehicles is encouraging registrants to report stolen registration cards to authorities.

What is a “stamp” used for on Form 5500-EZ?

In the past, a “stamp” was used to register an elector in person. We use the term “stamp” instead of a “certificate” to differentiate it from a certificate of registration.

What types of voting do I have to do to obtain a Certificate of Voting Privileges?

You must register as a qualified elector in one of the following categories:

Clerks (including provisional and provisional registrants) who register at the polls

Noncitizens, military, overseas, and incarcerated voters

All registered voters in each of the counties in which you reside

The registrant must complete a Certificate of Voting Privileges form, indicating what category they want to receive this privilege

Do I need to use the same form every time I register to vote?

Not at all. Registrants may print, sign, or affix the Certificate of Voting Privileges form to their registration form.

What happens if I don't return my Certificate of Voting Privileges?

If you do not return your Certificate of Voting Privileges within 10 days of receiving it, you lose your vote privilege. If you vote under a different name, you lose your vote privilege until you return your Certificate of Voting Privileges to the county board of registrars for replacement.

What documents do I need to attach to my Form 5500-EZ?

We ask for copies of all official documents you have when filing your Form 5500-EZ, such as (1) the tax return of any self-employed or sole proprietorship employer (if applicable) issued on or before January 1, 2006, (2) the Social Security card, (3) the tax-exempt bond issued by any nonprofit organization described in the definition of charity or (4) a letter from you to the IRS or the IRS's private collection agency to request the information. Attach copies of your tax return, Social Security cards, and tax-exempt bonds to your Form 5500-EZ electronically.

If all of your documents are available electronically, there are no penalties for electronically filing your form and for failing to attach a copy of your return.

Do I also have to attach a copy of my tax return if my return has been altered?

No! The only exception is when you provide a copy of your original Form 5500-EZ or the original return when requested by the IRS. To satisfy the requirements for filing electronically you must, by the filing date, file any amended return(s) (or if you had no amended returns, you must file and furnish an amended return) on the same due date as your original return(s) filed electronically.

What am I required to supply the IRS?

The information you must supply may vary depending upon which documents you need to show on your Form 5500-EZ. Generally, however, you will need to provide the following information:

Name of Employer

Taxpayer's Social Security Number

Name of Employer's Agent

Date and Reason for Attending School

Amount of School Leave Accrual (Amount depends on the type of leave(s) which include:

Fees,

Vacation,

Personal Time/Work)

Employer's Telephone Contact Information

Employer's Address

Employer's Email

Employer's Business Phone/Fax Number

School's Business Phone/Fax Number

What type of documents do I need to give to the IRS?

We ask you to provide the following information; however, you must be specific, and we will not ask anyone other than you for the information that is listed below.

What are the different types of Form 5500-EZ?

You can only fill out one Form 5500-EZ per calendar year. So if you sign up for two Form 5500-EZs in the same calendar year you'll be on the same form for two years.

Why is the number 2 in the date field different from the number 1 in the date field on your signed form?

This is to protect yourself in case your Form 5500-EZ is found to be fraudulent.

When should I check my Form 5500-EZ and if I've changed my address should I update my information?

Once you fill out your information, it will still be in effect for one to two years after the date on the form, so you don't need to check again.

A mistake was made when I signed up. Should I file a corrected form?

Nope.

Does the IRS still accept the Form 5500-EZ for new members applying for a tax credit or exemption?

The IRS is currently accepting applications for new members to receive Form 5500-EZs online with the “Apply for a Federal Tax Credit/Exemption” option.

If you're not still applying for a credit, we recommend you check with your state tax department to see whether you can get a credit through your state tax code.

Does the IRS allow me to file a Form 5500-EZ for more than one individual?

Yes, if you have more than one tax return on file, you can file one Form 5500-EZ for each individual. We recommend you wait to fill out one form until you've filed all of your returns. Once all of your returns are finished and processed, you can then fill out the other Form 5500-EZ.

If I'm a nonimmigrant, can I request the Form 5500-EZ as a nonimmigrant?

The Form 5500-EZ is currently only available as a form for individuals who are nonimmigrants to the United States for the tax year.

I filed with my employer and don't have health insurance. Do I need to submit a paper Form 5500-EZ to my employer as a Form 1040?

No.

Do I need to submit a paper Form 5500-EZ to my employer (e.g. self-employed or self-employed contractor)?

Yes.

How many people fill out Form 5500-EZ each year?

Approximately 5,500 people fill out Form 5500-EZ each year. About 90% of the people who fill out Form 5500-EZ are married couples who make a joint filing together. In addition, there are many single individuals who file Form 5500-EZ.

How long is the average filing time for a FIT filing?

Form 5500-EZ is issued for the entire calendar year. An average filing date is typically 5 days before the tax filing due date. This means that, if Form 5500-EZ is to be filed on August 4, 2017, an individual may file it on January 3, 2018. (For example, if the filing due date is September 10, 2017, an individual may file the Form on January 3, 2018.) If the Form 5500-EZ is made payable to the Secretary of the Treasury, a taxpayer may claim the credit for the full tax imposed on the taxpayer's earlier year (i.e., the tax for the current year minus the tax due) before filing a separate Form 5500-EZ in that taxpayer's later year (July 1, 2018). However, a taxpayer should take caution when claiming credit for a tax that is not yet due and payable, for example, the earned income credit.

What is a filing status?

Filing Status

The IRS designates filing status when you file a Form 5500-EZ. The tax filing status given to you depends on whether you are filing with, or amending, a return.

Single with no dependents Under

Single, Head of Household Under

Married Filing Jointly Under

Married Filing Separately Under

Head of Household

Head of Household

Head of Household

The filing status that corresponds to the filing status given to you by the IRS changes during the year. For example, the filing status assigned to a married couple filing jointly changes in April of each year. This change may be reflected by the name of the filing status given to the couple by the IRS in the 2017 tax return, and in subsequent tax returns, which will vary from year to year.

Is there a due date for Form 5500-EZ?

If you received this form during the 2016 tax year, the due date for Form 5500-EZ is May 16, 2017. If you received this form prior to the 2016 tax year, please contact the Internal Revenue Service to let them know. If your submission of Form 5500-EZ was in error, and you have already sent it to us, please submit a Form 4868 in its place.

If I need to apply for a refund of tax, does Form 5500-EZ need to be filed?

If you are claiming an exemption on your return from the Social Security Administration, the Supplemental Security Income (SSI) program, or unemployment tax, the Form 5500-EZ should be filed within 21 days of receiving the Form 5500-EZ. If you are claiming another form of tax exemption or filing an amended return, it's important that Form 5500 show the correct amount of tax withheld.

If I need to file a tax return and I received an e-file e-mail from the IRS, does Form 5500-EZ still need to be filed?

Due to e-filing changes made by the IRS in April 2017, Form 5500-EZ will no longer be accepted. You should file your tax return using your e-file e-mail address or a paper return submission address if you received a paper Form 5500-EZ in error.

How do I apply to become an extension agent?

There is no fee for applying to become an extension agent. After submitting a completed Form 5498, please wait 60 days to receive a response via mail.

When and where can I visit an online extension agent?

Each extension agent has an online web page where you can see available extensions and search for information about the various programs that are open depending on the filing status.

For convenience, agents will sometimes host office hours. They may have appointments available, or they may be able to make telephone or mail appointments.

Does Form 5498 need to be filed for my return?

No.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here